☐

☒

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Notice

of Stockholdersour values is our commitment to people and Proxy Statement

EXTERRAN CORPORATION

Thursday, April 27, 2017 at 8:30 a.m., Central Daylight Time

4444 Brittmoore Rd., Houston, Texas 77041

YouStockholders:

Enclosed you will find a meeting notice, a related Proxy Statement, a proxy or voting instructions and our 2016 Annual Report, which includes a more detailed letter regarding the state of Exterran. The Proxy Statement provides further information on the Company’s performance, corporate governance and enhanced descriptions of our compensation approach.

The past year was a period of transition for Exterran asthings we completed our first full yearare doing to operate sustainably as a public company. good corporate citizen.

Despiteareas of oil, natural gas, power generation and water. At the external market challenges and the required internal efforts to complete the restatement, yoursame time, our Board and management team did not lose sight of the needwill continue to navigate Exterran through this period of uncertaintyfocus on building and positionmaintaining a strong foundation for the Company, highlighted by ensuring a culture of accountability and core values are in place, supported by internal processes, systems and controls.

As highlightedcontinue to expand our engagement efforts. We believe we can learn a lot from people who have placed their faith in us through their investments. You will find in this proxy information on how to contact us throughout the Proxy Statement and Annual Report, we sized the business to manage through the current market challenges, focused on generating and preserving cashyear as well as repaying debt. The end result wasinformation about what is up for a stronger balance sheet, leaner organization and an evolving culture emphasizing accountability, stewardship, oversight, controls and transparency. We believe the seeds of disciplined growth and stockholder value creation are planted, supported by a compensation philosophy aimed at rewarding financial performance, strategic and operational execution, and safety.

We encourage you to vote, your shares as soon as possible. Your vote is important to us. You will find instructions in the Proxy Statement on how to vote your shares by proxy and/or in person if you attend theand how to join us at our annual meeting.

Thank you for your continued support and investment in Exterran Corporation.

To Be Held

at King & Spalding LLP

, Al Fattan Currency House, Tower 2, Level 24, Dubai International Financial Centre, Dubai, UAE. We are holding a live annual meeting simultaneously in two locations by tele-video conferencing in order to allow our international stockholders to attend in person. TheThe Board of Directors of Exterran Corporation has fixedor any adjournments or postponements thereof is the close of business on February 27, 2017 as the record date for the meeting. Only holders of our common stock as of the record date are entitled to notice of and to vote at the annual meeting. Further information regarding voting rights and the matters to be voted upon is presented in this Proxy Statement.

28, 2018.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on April 27, 2017:

This Proxy Statement and the Company’s 2016 Annual Report to Stockholders are availablefree of charge on the Company’s website athttp://www.proxyvote.com and also whereindicated on the proxy card that accompanies this notice.

Table Of Contents

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 26, 2018 | |

We are making our Proxy Statement and Annual Report available to our stockholders electronically via the Internet. We will mail most of our stockholders a Notice on or about March 16, 2018, containing instructions on how to access this Proxy Statement and our Annual Report over the Internet and Vote by Internet or telephone. All stockholders who do not receive a Notice should receive a paper copy of the proxy materials by mail. Stockholders may access the proxy materials at www.exterran.com or www.proxyvote.com or request a printed set of the proxy materials be sent to them by following the instructions in the Notice. |

i

ii

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

We are furnishing you

| PROXY SUMMARY |

We are making our proxy materials available over the Internet. Accordingly, we will mail most of our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) on or about March 17, 2017. The Notice contains instructions on how to access those documents over the Internet, as well as instructions on how to request a printed copy of our proxy materials. All stockholders who do not receive a Notice should receive a paper copy of the proxy materials by mail. Stockholders may access the proxy materials on the Internet or request a printed set of the proxy materials be sent to them by following the instructions in the Notice.

We may satisfy Securities and Exchange Commission (“SEC”) rules regarding delivery of the Notice by delivering a single copy of these documents to an address shared by two or more stockholders. This process is known as “householding.” To the extent we have done so, we have delivered only one Notice to stockholders who share an address with another stockholder, unless contrary instructions were received prior to the mailing date.

When and where will the Annual Meeting be held?

We will hold our 2017 Annual Meeting of Stockholders at Exterran Corporation, 4444 Brittmoore Road, Houston, Texas 77041, on Thursday, April 27, 2017, at 8:30 a.m. Central Daylight Time.

Who may vote?

You may vote if you were a holder of record of Exterran common stock as of the close of business on February 27, 2017, the record date for the Annual Meeting. Each share of common stock is entitled to one vote. As of the record date, there were 35,582,110 shares of Exterran common stock outstanding and entitled to vote.

What am I voting on and how does the Board recommend that I vote?

| Proposal No. | Description of Proposal | Page No. Where You Can Find More Information Regarding the Proposal | Board Recommendation |

| 1 | Election of eight directors to serve for a term expiring at the next annual meeting of stockholders | 4 | FOR each nominee |

| 2 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2017 | 42 | FOR |

| 3 | Advisory vote to approve the compensation paid to our named executive officers | 44 | FOR |

| 4 | Advisory vote on the frequency of future stockholder advisory votes on the compensation paid to our named executive officers | 45 | 1 YEAR |

In addition, stockholders will be asked to consider at the Annual Meeting such other business as may properly come before the meeting or any adjournment thereof.

How do I vote?

You may vote by any of the following methods:

|

|

|

|

To be counted, votes by Internet, telephone or mail must be received by 11:59 p.m. Eastern Daylight Time on April 26, 2017.

Can I change my vote?

Yes. You may change your vote or revoke your proxy before the voting polls are closed at the Annual Meeting by the following methods:

How many votes must be present to hold the Annual Meeting?

A quorum of stockholders is necessary for a valid meeting. The presence in person or by proxy of the holders of a majority of the outstanding shares of our common stock will constitute a quorum for the Annual Meeting. Under our Amended and Restated Bylaws (our “Bylaws”) and under Delaware law, abstentions and “broker non-votes” are counted as present in determining whether the quorum requirement is satisfied.

What is a broker non-vote?

A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that proposal and has not received instructions from the beneficial owner. Under the rules of the New York Stock Exchange (“NYSE”), brokers do not have discretionary authority to vote shares in connection with non-routine matters without instructions from the beneficial owner. Therefore, if you hold your shares in the name of a bank, broker or other holder of record, for your vote to be counted on any of the proposals other than Proposal 2 (ratification of independent registered public accounting firm), you will need to communicate your voting decisions to your bank, broker or other holder of record before April 27, 2017.

What matters will be voted on at the Annual Meeting?

Each proposal to be voted on at the Annual Meeting is described in this Proxy Statement, as is the vote required to approve each proposal. For any other matters that may be properly presented for consideration at the Annual Meeting, the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. As of the date of this Proxy Statement, we do not anticipate that any other matters will be properly presented for consideration at the Annual Meeting.

Who pays for the proxy solicitation related to the Annual Meeting?

We will pay the cost of soliciting proxies. In addition to sending you these proxy materials or otherwise providing you access to these proxy materials, some of our officers, as well as management and non-management employees, may contact our stockholders by telephone, facsimile or in person. None of these officers or employees will receive additional compensation for any such solicitation. We have also retained Innisfree M&A Incorporated to assist in the solicitation of proxies as well as provide advisory services to the Company, for a fee of $15,000 plus out-of-pocket expenses which will be paid by the Company. We will also request brokers and other fiduciaries to forward proxy soliciting materials to the beneficial owners of shares of our common stock that are held of record by such brokers and fiduciaries, and we will reimburse their reasonable out-of-pocket expenses.

If you have any questions or require any assistance with voting your shares, please contact Innisfree M&A Incorporated, our proxy solicitor, toll-free at (888) 750-5834. Banks and brokers may call collect at (212) 750-5833.

INNISFREE M&A INCORPORATED

501 Madison Avenue, 20th Floor New York, NY 10022

Stockholders May Call Toll-Free: (888) 750-5834 (from the United States and Canada)

Banks and Brokers May Call Collect: (212) 750-5833

How can I view the stockholder list?

A complete list of stockholders of record entitled to vote at the Annual Meeting will be available for viewing during ordinary business hours for a period of ten days before the Annual Meeting at our offices at 4444 Brittmoore Road, Houston, Texas 77041.

Who will tabulate and certify the vote?

Broadridge Financial Solutions, Inc., an independent third party, will tabulate and certify the vote and will have a representative to act as the independent inspector of elections for the Annual Meeting.

What if I want a copy of the Company’s 2016 Annual Report on Form 10-K?

We will provide to any stockholder or potential investor, without charge, upon written or oral request, by first class mail or other equally prompt means, a copy of our Annual Report on Form 10-K for the year ended December 31, 2016. Please direct any such requests2017. In this Proxy Statement, we refer to the attention of Investor Relations, Exterran Corporation 4444 Brittmoore Rd.as “Exterran,” the “Company,” “we” or “us.”

| Date: | Thursday, April 26, 2018 |

| Time: | Jointly by tele-video conferencing at 8:30 a.m. Central Daylight Time and 5:30 p.m. Gulf Standard Time, respectively |

| Place: | King & Spalding LLP, 1111 Louisiana Street, Suite 4000, Houston, Texas, USA and Al Fattan Currency House, Tower 2, Level 24, Dubai International Financial Centre, Dubai, UAE |

| Record Date: | February 28, 2018 |

| Proposals | Board Recommendation | Page | |

| Proposal 1 | Election of Directors | FOR each Director Nominee | 5 |

| Proposal 2 | Advisory Vote to Approve Named Executive Officer Compensation | FOR | 49 |

| Proposal 3 | Ratification of Independent Registered Public Accounting Firm | FOR | 50 |

| Proposal 4 | Approval of Amendment to Amended and Restated Certificate of Incorporation to Eliminate Super-Majority Vote Required for Stockholders to Amend Bylaws | FOR | 53 |

|  |  |  | |||

| Using the Internet at http://www.proxyvote.com | Calling 1-800-690-6903 if in the United States and Canada | Mailing your signed and dated proxy card or voting instruction form | Attending the Annual Meeting | |||

reduced to seven members immediately following the Annual Meeting.

| Name | Age | Independent | Director Since | Primary Occupation | Committee Memberships | |||||

William M. Goodyear (Lead Independent Director) | 69 | Yes | 2015 | Retired Executive Chairman and Chief Executive Officer of Navigant Consulting, Inc. | Audit (Chair) Compensation | |||||

| James C. Gouin | 58 | Yes | 2015 | President and Chief Executive Officer of Tower International, Inc. | Audit Compensation | |||||

| John P. Ryan | 66 | Yes | 2015 | Retired President and Chief Executive Officer of Dresser, Inc. | Audit Compensation (Chair) Nominating and Corporate Governance | |||||

| Christopher T. Seaver | 69 | Yes | 2015 | Retired President and Chief Executive Officer of Hydril Company | Audit Compensation Nominating and Corporate Governance (Chair) | |||||

Mark R. Sotir Executive Chairman | 54 | No | 2015 | Executive Chairman and Director | ||||||

| Andrew J. Way | 46 | No | 2015 | President, Chief Executive Officer and Director | ||||||

| Ieda Gomes Yell | 61 | Yes | 2015 | Retired Managing Director, Energix Strategy Ltd. | Nominating and Corporate Governance | |||||

| Changes Since 2017 Annual Meeting | Ÿ | Following our Board’s amendment of our Amended and Restated Bylaws (“Bylaws”) to eliminate the super-majority vote required for stockholders to amend our Bylaws, we have included Proposal 4 in this proxy to make the same change in our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) | |

| Ÿ | After review of best practices and discussions with stockholders, we amended our Bylaws to provide for majority voting in uncontested elections of directors | ||

| Ÿ | We implemented a prohibition on pledging Company stock | ||

| Ÿ | We increased the stockholder ownership guidelines for our Chief Executive Officer (“CEO”) | ||

| Ÿ | We expanded our stockholder engagement process | ||

| Corporate Governance Best Practices | We provide for: | ||

| Ÿ | Annual election of directors | ||

| Ÿ | Majority voting for directors | ||

| Ÿ | Resignation policy for directors who do not receive majority vote | ||

| Ÿ | Regular executive sessions of independent directors | ||

| Ÿ | Lead Independent Director | ||

| Ÿ | Mandatory director retirement policy | ||

| Ÿ | Robust director and executive stock ownership guidelines | ||

| Ÿ | Robust Code of Conduct | ||

| Ÿ | No poison pill | ||

| Ÿ | No political contributions | ||

| Lead Independent Director Responsibilities | Ÿ | Presides at executive sessions of the independent directors | |

| Ÿ | Calls meetings of the independent directors | ||

| Ÿ | Serves as liaison between the Chairman and the independent directors | ||

| Ÿ | Meets regularly with the Company’s finance, compliance and internal audit management and independent advisers | ||

| Ÿ | Briefs CEO on issues arising from executive sessions of independent directors | ||

| BOARD OF DIRECTORS |

ELECTION OF DIRECTORS

Director Nominees

TheOur Board of Directors has nominated for election as Directors at the Annual Meeting the eightseven nominees named below. IfEach nominee currently serves as a director of the Company and was elected eachby our stockholders at our 2017 annual meeting. Each nominee elected will serve until the 20182019 Annual Meeting of Stockholders or until their successors havehis or her successor has been elected and qualified or until theirhis or her death, resignation or removal.

The Board of Directors

Each nominee brings a strong and unique background and set of skills to the

Eight directors are nominated to be elected to the Board at the Annual Meeting, each to serve for a term expiring at our next annual meeting of stockholders. Each nominee has consented to serve as a director if elected.

Board of Directors’ Recommendation

The Boardunanimously recommends that the stockholders vote“FOR”the election of each of the nominees to the Board as set forth in this proposal.

Vote Required

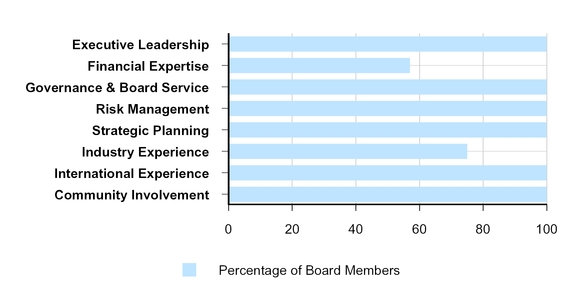

Key Skills and Qualifications | Importance | |

| Executive Leadership | Directors who hold or have held significant leadership positions provide the Company with unique insights. These people generally possess extraordinary leadership qualities as well as the ability to identify and develop those qualities in others. Their experiences developing talent and solving problems in large, complex organizations prepare them well for the responsibilities of Board service. | |

| Financial Expertise | Accurate financial reporting and robust auditing are critical to our success. Four of our directors qualify as audit committee financial experts, and all of our directors are literate in finance and financial reporting processes. | |

Governance & Board Service | As a publicly traded energy Company, we are regulated by the Securities and Exchange Commission (“SEC”), the New York Stock Exchange (“NYSE”) and other governmental entities. As such, we seek directors with experience with publicly traded companies to provide insight and understanding of requirements and strategies in these areas. | |

| Risk Management | Managing risk in a rapidly changing environment is critical to our success. Directors should have a sound understanding of the most significant risks facing the Company and the experience and leadership to provide effective oversight of risk management processes. | |

| Strategic Planning | Experience in driving the strategic direction and growth provides the Company with needed oversight and guidance in the design and implementation of our strategic growth plan. | |

| Industry Experience | Due to the complexity and volatility of our business, we believe it is important to have directors with experience in the energy industry or energy operations to enable the Board to provide effective oversight of our business and operations. | |

| International Experience | With our global growth, directors having a global business awareness provide needed cultural and diverse experiences and competencies. | |

| Community Involvement | Directors who are involved in community or charitable organizations understand the interests and needs of our customers and communities, and provide effective oversight of our social responsibilities to all our stakeholders. | |

| WILLIAM M. GOODYEAR | Exterran Board Committees • Audit (Chair)• Compensation | |

| Age 69 Director Since October 2015 | |||

| Lead Independent Director | Other Public Boards • Enova International, Inc. | ||

WILLIAM M. GOODYEAR

| JAMES C. GOUIN | Exterran Board Committees • Audit• Compensation | |

| Age 58 Director Since November 2015 | |||

| Independent | Other Public Boards • Tower International, Inc. | ||

| Professional Experience | Skills and Qualifications | ||

| Mr. Gouin was appointed President of Tower International, Inc. (“Tower”), a global manufacturer of engineered automotive products, in September 2016 and became Chief Executive Officer and a member of Tower’s board of directors in January 2017. Mr. Gouin joined Tower in November 2007 as Executive Vice President and Chief Financial Officer. Prior to joining Tower, Mr. Gouin served in 2007 as a senior managing director of the corporate financial practice of FTI Consulting, Inc., a business advisory firm. Prior to joining FTI, Mr. Gouin spent 28 years at Ford Motor Company in a variety of senior positions, including as Vice President, Finance and Global Corporate Controller from 2003 to 2006 and as Vice President of Finance, Strategy and Business Development of Ford Motor Company’s International Operations from 2006 to 2007. Mr. Gouin also served on the board of directors of Azure Dynamics Corp. from January 2009 until May 2012. Azure Dynamics filed for bankruptcy protection in April 2012. Mr. Gouin also served on the Board of Trustees of the University of Detroit Mercy until October 2017, and currently serves as Chairman of the Board of Directors of Vista Maria, a non-profit corporation. Mr. Gouin received a B.B.A. from the Detroit Institute of Technology and a M.B.A. from the University of Detroit Mercy. | • Executive Leadership• Financial Expertise• Governance & Board Service• Risk Management• Strategic Planning• International Experience• Community Involvement | ||

| JOHN P. RYAN | Exterran Board Committees • Audit• Compensation | |

| Age 66 Director Since October 2015 | |||

| Independent | • Nominating and Corporate Governance | ||

| Professional Experience | Skills and Qualifications | ||

| Mr. Ryan previously served as President and Chief Executive Officer of Dresser, Inc., a global provider of flow control products, measurement systems and other infrastructure technologies to the oil and gas and power generation industries, from May 2007 until February 2011. Mr. Ryan was President and Chief Operating Officer of Dresser, Inc. from December 2004 to June 2007. From 1987 to 2004, Mr. Ryan was employed by Dresser Wayne where he served as President from 1996 to 2004 and as Vice President from 1991 to 1996. He previously served on the board of directors of each of FlexEnergy, LLC, a provider of oil field turbine generators and environmental solutions for power generation, landfill gas and digester gas applications, from January 2012 to April 2013 and Wayne Fueling Systems, Inc., a privately-held global supplier of fuel dispensers, payment terminals and other measurement and control solutions to the retail and commercial fueling industry from April 2014 to November 2016. Prior to September 2017, Mr. Ryan served as a director of Hudson Products, Inc., a company engaged in the design, manufacture and servicing of heat transfer equipment for the petroleum, chemical, gas processing and electric utility industries, and currently serves as a director of The Village of Hope, a non-profit organization. Mr. Ryan received a B.A. from Villanova University. | • Executive Leadership• Financial Expertise• Governance & Board Service• Risk Management• Strategic Planning• Industry Experience• International Experience• Community Involvement | ||

| CHRISTOPHER T. SEAVER | Exterran Board Committees • Audit• Compensation | |

| Age 69 Director Since October 2015 | |||

| Independent | • Nominating and Corporate Governance (Chair)Other Public Boards • Oil States International, Inc.• McCoy Global, Inc. | ||

| Professional Experience | Skills and Qualifications | ||

| Mr. Seaver served as Chairman of the board of directors of Hydril Company, an oil and gas service company specializing in pressure control equipment and premium connections for casing and tubing, from 2006 until his retirement in May 2007. Mr. Seaver held a series of domestic and international management positions at Hydril Company from 1985 to May 2007, including as President since 1993 and Chief Executive Officer and director since 1997. Prior to joining Hydril Company, Mr. Seaver was a corporate and securities attorney for the law firm of Paul, Hastings, Janofsky & Walker LLP, and was a Foreign Service Officer in the U.S. State Department with postings in Kinshasa, Republic of Congo and Bogotá, Colombia. Mr. Seaver has served as a director and officer of the Petroleum Equipment Suppliers Association, a director of the American Petroleum Institute, and a director and Chairman of the National Ocean Industries Association. Mr. Seaver is currently on the board of trustees of two non-profit organizations. Mr. Seaver received an A.B. in Economics from Yale University and a J.D. and M.B.A. from Stanford University. | • Executive Leadership• Financial Expertise• Governance & Board Service• Risk Management• Strategic Planning• Industry Experience• International Experience• Community Involvement | ||

| MARK R. SOTIR | Exterran Board Committees | |

| Age 54 Director Since October 2015 | |||

| Executive Chairman | |||

| Professional Experience | Skills and Qualifications | ||

| Mr. Sotir has served as director and Executive Chairman of the Company since October 2015. Mr. Sotir has also served as Co-President of the Equity Group Investments division of Chai Trust Company, LLC, a private investment firm (“EGI”), since October 2015, and served as Managing Director of EGI since November 2006. While at EGI, he served as the interim president of Tribune Interactive, a division of Tribune Company, a media conglomerate, from December 2007 until April 2008. Tribune Company filed for protection under Chapter 11 of the Bankruptcy Code in December 2008. Prior to joining EGI, Mr. Sotir was the Chief Executive Officer of Sunburst Technology Corporation, an independent distributor of educational software to public schools, from August 2003 to November 2006. Mr. Sotir serves on the board of directors of several EGI portfolio companies, including SIRVA Inc., a provider of moving and relocation services. Mr. Sotir is also involved in various charitable organizations. Mr. Sotir received a B.A. in Economics from Amherst College and an M.B.A. from Harvard Business School. | • Executive Leadership• Financial Expertise• Governance & Board Service• Risk Management• Strategic Planning• Industry Experience• International Experience• Community Involvement | ||

| ANDREW J. WAY | Exterran Board Committees | |

| Age 46 Director Since October 2015 | |||

| President and Chief Executive Officer | |||

| Professional Experience | Skills and Qualifications | ||

| Mr. Way is our President and Chief Executive Officer. He previously served as Vice President and Chief Executive Officer-Drilling and Surface Production of GE Oil & Gas, a provider of equipment and services in the oil and gas space, from 2012 through June 2015. Mr. Way joined GE Oil & Gas in October 2007 and previously served as General Manager Operations, Turbo Machinery Services from October 2007 to December 2008, as General Manager, Global Supply Chain from December 2008 to December 2010, and as Vice President and Chief Executive Officer-Turbo Machinery Services from December 2010 to June 2012. Prior to joining GE Oil & Gas, Mr. Way served as Operations Director and Managing Director-GE Equipment Services of GE Capital from 2001 to 2007 and held various positions at GE Aviation from 1996 to 2001. Mr. Way has served as an Advisory Director of the Petroleum Engineering and Services Association since August 2017, and is actively involved in various civic and charitable organizations. Mr. Way studied Mechanical Engineering and graduated from the technical leadership program with Lucas Industries in Wales, U.K. | • Executive Leadership• Financial Expertise• Governance & Board Service• Risk Management• Strategic Planning• Industry Experience• International Experience• Community Involvement | ||

| IEDA GOMES YELL | Exterran Board Committees • Nominating and Corporate Governance | |

| Age 61 Director Since October 2015 | |||

| Independent | Other Public Boards • Bureau Veritas S.A.• Saint-Gobain S.A. | ||

| Professional Experience | Skills and Qualifications | ||

| Ms. Gomes Yell served as the Managing Director of Energix Strategy Ltd., an independent oil and gas consultancy firm, until October 2017. Before forming Energix, she served in a number of positions with BP plc and its subsidiaries from 1998 to 2011, including as President of BP Brazil, Vice President of Regulatory Affairs and Vice President of Market Development for BP Solar, and Vice President of Pan American Energy. From 1995 until 1998, Ms. Gomes Yell held a number of positions with Companhia de Gás de São Paulo, or Comgás, a Brazilian natural gas distributor, including as President and Chief Executive Officer. Ms. Gomes Yell is Chairman of the corporate governance committee of InterEnergy Holdings, a private power production company; a Councillor of the Brazilian Chamber of Commerce in Great Britain, a not-for-profit organization; a founding director of WILL Latam-Women in Leadership in Latin America, a non-profit organization; a member of the advisory board of Crystol Energy, an independent consultancy and advisory firm; and a member of the advisory board of Comgás and of the Infrastructure Department of the São Paulo Federation of Industries. Ms. Gomes Yell is a senior visiting research fellow at the Oxford Institute for Energy Studies in the United Kingdom and Fundação Getúlio Vargas Energia in Brazil. Ms. Gomes Yell received her B.S. in Chemical Engineering from the University of Bahia, Brazil, a MSc. in Environmental Engineering from the Polytechnic School of Lausanne, Switzerland and a MSc. in Energy from the University of São Paulo, Brazil. | • Executive Leadership• Financial Expertise• Governance & Board Service• Risk Management• Strategic Planning• Industry Experience• International Experience• Community Involvement | ||

| CORPORATE GOVERNANCE AT EXTERRAN |

As the former Chief Executive Officer and former Executive Chairman of the board of Navigant Consulting, Inc., Mr. Goodyear has significant business consulting experience, including with operational, risk management, financial, regulatory and dispute advisory services. As a former chief executive officer, he also has significant experience in management and business strategy, and as a former public company chairman he is familiar with a full range of board functions.

|

|

JAMES C. GOUIN

Mr. Gouin, 57, was appointed President of Tower International, Inc. (“Tower”) in September 2016 and became Chief Executive Officer and a member of Tower’s board of directors in January 2017. Mr. Gouin joined Tower in November 2007 as Executive Vice President and Chief Financial Officer. Prior to joining Tower, Mr. Gouin served in 2007 as a senior managing director of the corporate financial practice of FTI Consulting, Inc., a business advisory firm. Prior to joining FTI, Mr. Gouin spent 28 years at Ford Motor Company in a variety of senior positions, including as the Vice President, Finance and Global Corporate Controller from 2003 to 2006 and as the Vice President of Finance, Strategy and Business Development of Ford Motor Company’s International Operations from 2006 to 2007. Mr. Gouin also served on the board of directors of Azure Dynamics Corp. from January 2009 until May 2012. He serves on the board of trustees of the University of Detroit Mercy and he is the Chairman of the board of directors of Vista Maria, a non-profit corporation. Mr. Gouin received a B.B.A. from the Detroit Institute of Technology and an M.B.A. from the University of Detroit Mercy.

Mr. Gouin brings a wealth of financial experience to theOur Board as well as managerial, manufacturing and global experience through his years of service at Tower and Ford Motor Company.

|

|

JOHN P. RYAN

Mr. Ryan, 65, previously served as President and Chief Executive Officer of Dresser, Inc., a global provider of flow control products, measurement systems and other infrastructure technologies to the oil and gas and power generation industries, from May 2007 until February 2011. Mr. Ryan was President and Chief Operating Officer of Dresser, Inc. from December 2004 to June 2007. From 1987 to 2004, Mr. Ryan was employed by Dresser Wayne where he served as President from 1996 to 2004 and as Vice President from 1991 to 1996. He previously served on the board of directors of each of FlexEnergy, LLC, a provider of oil field turbine generators and environmental solutions for power generation, landfill gas and digester gas applications, from January 2012 to April 2013 and Wayne Fueling Systems, Inc., a privately-held global supplier of fuel dispensers, payment terminals and other measurement and control solutions to the retail and commercial fueling industry from April 2014 to November 2016. Mr. Ryan currently serves as a director of Hudson Products, Inc., a company engaged in the design, manufacture and servicing of heat transfer equipment for the petroleum, chemical, gas processing and electric utility industries; and as a director of The Village of Hope, a non-profit organization. Mr. Ryan received a B.A. from Villanova University.

As the former President and Chief Executive Officer of Dresser, Inc., Mr. Ryan has significant international experience and energy industry knowledge, as well as a combination of commercial, operational and financial skills. With an early career in engineering, manufacturing and sales, Mr. Ryan also brings a thorough understanding of these disciplines.

|

|

CHRISTOPHER T. SEAVER

Mr. Seaver, 68, served as Chairman of the board of directors of Hydril Company, an oil and gas service company specializing in pressure control equipment and premium connections for casing and tubing from 2006 until his retirement in May 2007. Mr. Seaver held a series of domestic and international management positions at Hydril Company from 1985 to May 2007, including as President since 1993 and Chief Executive Officer and director since 1997. Prior to joining Hydril Company, Mr. Seaver was a corporate and securities attorney for the law firm of Paul, Hastings, Janofsky & Walker LLP, and was a Foreign Service Officer in the U.S. State Department with postings in Kinshasa, Republic of Congo and Bogotá, Colombia. Mr. Seaver currently serves as a director and member of the audit committee of Oil States International, Inc., an oil service company specializing in manufacturing products for offshore production and drilling, renting drilling and completion tools, and U.S. land drilling services; and a director and Chairman of McCoy Global Inc., a Canadian oil service company principally providing power tongs and related equipment. Mr. Seaver has also served as a director and officer of the Petroleum Equipment Suppliers Association, a director of the American Petroleum Institute, and a director and Chairman of the National Ocean Industries Association. Mr. Seaver received an A.B. in Economics from Yale University and a J.D. and M.B.A. from Stanford University.

Through his former roles as President, Chief Executive Officer and Chairman of the Board of a publicly traded oil and gas services company, Mr. Seaver brings to our Board both the perspective of an executive officer as well as that of a director. He has both domestic and international management and operations experience and has been heavily involved in many industry trade and professional organizations. His tenure with the U.S. State Department makes him well-versed in international cultures and the challenges and opportunities presented by conducting business in developing countries.

|

|

MARK R. SOTIR

Mr. Sotir, 53, has served as director and Executive Chairman of the Company since October 2015. Mr. Sotir has also served as Co-President of the Equity Group Investments division of Chai Trust Company, LLC, a private investment firm (“EGI”), since October 2015, and prior to taking his current position, served as Managing Director since November 2006. While at EGI, he served as the interim president of Tribune Interactive, a division of Tribune Company, a media conglomerate, from December 2007 until April 2008. Tribune Company filed for protection under Chapter 11 of the Bankruptcy Code in December 2008. Prior to joining EGI, Mr. Sotir was the Chief Executive Officer of Sunburst Technology Corporation, an independent distributor of educational software to public schools, from August 2003 to November 2006. Mr. Sotir serves on the board of directors of several EGI portfolio companies, including Rewards Network Inc., a dining rewards company; SIRVA Inc., a provider of moving and relocation services; and Veridiam, a specialty manufacturer in the nuclear aerospace and medical industries. Mr. Sotir received a B.A. in Economics from Amherst College and an M.B.A. from Harvard Business School.

Mr. Sotir brings to our Board extensive operational experience, gained by serving in key management and leadership roles in a wide range of industries. His operational experience includes brand management, sales, marketing and distribution, as well as finance. In addition, Mr. Sotir serves as a director for several companies representing a diversity of industries.

|

|

RICHARD R. STEWART

Mr. Stewart, 67, previously served as President and Chief Executive Officer of GE Aero Energy, a division of GE Power Systems, and as an officer of General Electric Company, from February 1998 until his retirement in 2006. From 1972 to 1998, Mr. Stewart served in various positions at Stewart & Stevenson Services, Inc., including as Group President and member of the board of directors. Mr. Stewart is vice chairman of the board of directors of Eagle Materials Inc., a U.S. manufacturer and distributor of building materials; director and Chairman of the audit committee of Kirby Corporation, a tank barge operator; and director of TAS, a privately held company providing energy conversion solutions. Mr. Stewart served as a director of Lufkin Industries, Inc., an oilfield equipment and power transmission products company, from October 2009 until its acquisition by General Electric in July 2013. Mr. Stewart received a B.B.A. in Finance from the University of Texas.

Mr. Stewart brings business knowledge and leadership experience, as well as familiarity with corporate governance issues, as a result of his prior service as chief executive officer of a manufacturing company, as an officer of General Electric and as a member of the boards of other public companies.

|

|

ANDREW J. WAY

Mr. Way, 45, is our President and Chief Executive Officer. He previously served as Vice President and Chief Executive Officer—Drilling and Surface Production of GE Oil & Gas, a provider of equipment and services in the oil and gas space, from 2012 through June 2015. Mr. Way joined GE Oil & Gas in October 2007 and previously served as General Manager Operations, Turbo Machinery Services from October 2007 to December 2008, as General Manager, Global Supply Chain from December 2008 to December 2010, and as Vice President and Chief Executive Officer—Turbo Machinery Services from December 2010 to June 2012. Prior to joining GE Oil & Gas, Mr. Way served as Operations Director and Managing Director—GE Equipment Services of GE Capital from 2001 to 2007 and held various positions at GE Aviation from 1996 to 2001. Mr. Way studied Mechanical Engineering and graduated from the technical leadership program with Lucas Industries in Wales, U.K.

Mr. Way brings a wealth of global corporate leadership experience across many aspects of business, including finance, strategy, operations, and supply chain, from his years of service at GE, culminating in his position as Vice President and Chief Executive Officer-Drilling and Surface Production.

|

|

IEDA GOMES YELL

Ms. Gomes Yell, 60, has served as the Managing Director of Energix Strategy Ltd., an independent oil and gas consultancy firm, since October 2011. Before forming Energix, she served in a number of positions with BP plc and its subsidiaries from 1998 to 2011, including as President of BP Brazil, Vice President of Regulatory Affairs and Vice President of Market Development at BP Solar and Vice President of Pan American Energy. From 1995 until 1998, Ms. Gomes Yell held a number of positions with Companhia de Gás de São Paulo, or Comgás, a Brazilian natural gas distributor, before being named President and Chief Executive Officer. Ms. Gomes Yell is currently a non-executive director and member of the audit and risk and strategic committees at Bureau Veritas SA, a global provider of testing, inspection and certification services; a non-executive director of Compagnie de Saint Gobain SA, a France-based producer, processor and distributor of construction and high-performance materials and packaging; a director and Chairman of the corporate governance committee at InterEnergy Holdings, a private power production company; a Councillor of the Brazilian Chamber of Commerce in Great Britain, a not-for-profit organization; a founding director of WILL Latam—Women in Leadership in Latin America, a not-for-profit organization; a member of the advisory board of Crystol Energy, an independent consultancy and advisory firm; and a member of the advisory board of Comgás and of the Infrastructure Department of the São Paulo Federation of Industries. Ms. Gomes Yell is a senior visiting research fellow at the Oxford Institute for Energy Studies in the United Kingdom and Fundação Getúlio Vargas Energia in Brazil. Ms. Gomes Yell received her B.S. in Chemical Engineering from the University of Bahia, Brazil, a MSc. in Environmental Engineering from the Polytechnic School of Lausanne, Switzerland and a MSc. in Energy from the University of São Paulo, Brazil.

Throughout her career, Ms. Gomes Yell has cultivated extensive experience in developing projects, restructuring energy businesses and advising domestic and international oil and gas companies in a variety of operational and governance matters, including developing business strategies, navigating international markets and creating growth.

|

|

The Board believes that at least a majority of the directors should be persons who have no material relationship with our Company and who are otherwise “independent” under applicable NYSE listing standards. Currently, 75% of our directors are independent. Our Code of Business Conduct also requires all employees, officers and non-employee directors to avoid situations that may impact their ability to carry out their duties in an independent and objective fashion. Any circumstance that has the potential to compromise their ability to perform independently must be disclosed. In addition, we distribute director and officer questionnaires at least annually to elicit related-party information. The questionnaire requires that responses be updated throughout the year to the extent circumstances change.

The Nominating and Corporate Governance Committee assesses director independence each year by considering all direct and indirect business relationships between Exterran and each director (including his or her immediate family), as well as relationships with other for-profit concerns and charitable organizations and related party transactions, to determine whether any such relationship or transaction would prohibit a director from being independent under SEC rules, the NYSE listing standards and the Company’s Corporate Governance Principles. With the Nominating and Corporate Governance Committee’s recommendation, the Board makes a determination relating to the independence of each member, which is based on applicable laws, regulations, our Corporate Governance Principles and the rules of the NYSE and SEC.

During the Nominating and Corporate Governance Committee’s most recent review of independence, the Committee was provided information regarding transactions with any related parties as determined through a search of our accounting records as well as the responses to the director and officer questionnaires; these relationships were reviewed by the Nominating and Corporate Governance Committee and approved by the Audit Committee, and none are required to be reported in this Proxy Statement.

Based on the recommendation of the Nominating and Corporate Governance Committee, the Board determined that the following nominees for director are independent: Messrs. Goodyear, Gouin, Ryan, Seaver and Stewart and Ms. Gomes Yell.

Mr. Sotir is not independent because he is the Executive Chairman of the Company, and Mr. Way is not independent because he is the President and Chief Executive Officer of the Company.

We separate the roles of Executive Chairman of the Board and Chief Executive Officer. We believe this structure is currently in the best interests of our stockholders because by separating these positions:

The Board recognizes the time, effort and energy that our Chief Executive Officer is required to devote to his position, as well as the commitment required to serve as our Executive Chairman. The Board believes this structure is appropriate for the Company because of the size and composition of the Board, the scope and complexity of our operations and the responsibilities of the Board and management.

The Board has adopted procedures for the timely and efficient transfer of our Chief Executive Officer’s responsibilities in the event of an emergency or his sudden incapacitation or departure.

Mr. Sotir serves as Executive Chairman and presides over the regular sessions of the Board and the executive sessions of the Board, held at every regularly scheduled Board meeting.

Role of Lead Independent DirectorDirector.

Consistent with industry best practices and in accordance with the Company’s Corporate Governance Principles, the Board has a Lead Independent Director to ensure that the Company maintains a corporate governance structure with appropriate independence and balance. The Lead Independent Director is elected by the independent directors, and presides at the executive sessions of the independent directors which are held in conjunction with each regularly scheduled meeting of the Board, and any other meetings as determined by the Lead Independent Director. Mr. Goodyear presently serves as Lead Independent Director.

| Audit Committee | Ÿ | Assists the Board in fulfilling its oversight of financial risk exposures and implementation and effectiveness of the Company’s compliance programs and internal controls |

| Ÿ | Reviews the Company’s policies with respect to financial risk assessment and financial risk management | |

| Ÿ | Monitors the integrity of the Company’s financial statements and reporting systems and internal controls over financial reporting | |

| Ÿ | Appoints the independent auditors and monitors their qualifications and independence | |

| Ÿ | Monitors the performance of the Company’s internal auditors and independent auditors | |

| Ÿ | Meets with and reviews reports from the Company’s internal auditors and independent registered accounting firm | |

| Ÿ | Oversees environmental compliance, and climate, water and digital/cyber risks | |

| Ÿ | Oversees the Company’s Code of Conduct and Ethics Helpline, and meets with the Chief Compliance Officer to receive information regarding compliance policies and procedures | |

| Ÿ | Monitors the business practices and ethical standards of the Company | |

| Compensation Committee | Ÿ | Assists the Board in fulfilling its oversight of risks that may arise in connection with the Company’s compensation programs and practices |

| Ÿ | Reviews the Company’s compensation philosophy strategy | |

| Ÿ | Reviews the Company’s strategies and supporting processes for management succession planning, human capital and leadership development, executive retention and diversity | |

| Ÿ | Approves performance goals and total compensation for our President and CEO and conducts an annual review of the President and CEO’s performance | |

| Ÿ | Reviews and approves total compensation for the Company’s executive officers in consultation with the President and CEO | |

| Ÿ | Assesses and considers the independence of any adviser that provides advice to the Committee | |

| Nominating and Corporate Governance Committee | Ÿ | Assists the Board in fulfilling its oversight of risks that may arise in connection the Company’s governance processes and composition of the Board |

| Ÿ | Develops policies and practices relating to corporate governance and reviews compliance with the Company’s Corporate Governance Principles | |

| Ÿ | Reviews and recommends changes as appropriate in the Company’s Corporate Governance Principles, Certificate of Incorporation, Bylaws, and other Board-adopted governance provisions | |

| Ÿ | Identifies and recommends qualified individuals to become Board members | |

| Ÿ | Evaluates and recommends nominees for election as directors at the annual stockholders’ meetings or for appointment between annual stockholders’ meetings | |

| Ÿ | Reviews the composition and diversity of the Board and its committees and oversees the evaluation of the Board | |

| Ÿ | Oversees the Company’s stockholder engagement efforts | |

| Director | Independent | Board | Audit | Compensation | Nominating and Corporate Governance | |||||

| William M. Goodyear* | L | Ÿ | C | Ÿ | ||||||

| James C. Gouin* | Ÿ | Ÿ | Ÿ | Ÿ | ||||||

| John P. Ryan* | Ÿ | Ÿ | Ÿ | C | Ÿ | |||||

| Christopher T. Seaver* | Ÿ | Ÿ | Ÿ | Ÿ | C | |||||

| Mark R. Sotir | C | |||||||||

| Richard R. Stewart* | Ÿ | Ÿ | Ÿ | Ÿ | ||||||

| Andrew J. Way | Ÿ | |||||||||

| Ieda Gomes Yell | Ÿ | Ÿ | Ÿ | |||||||

| Number of 2017 Meetings | 7 | 7 | 9 | 6 | 4 | |||||

Ÿ Member | C Chair | L Lead Independent Director | * Financial Expert |

The Board has designated an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee to assist in the discharge of the Board’s responsibilities. The Board and the committees of the Board are governed by our Code of Business Conduct, Corporate Governance Principles and the applicable committee charters, each of which are available to the public on our website athttp://www.exterran.com or in print by submitting a written request to Exterran Corporation, 4444 Brittmoore Road, Houston, Texas 77041, Attention: Corporate Secretary. The purpose and composition of each committee is summarized in the table below.

| NON-EMPLOYEE DIRECTOR COMPENSATION |

COMMITTEE MEMBERSHIP

Members of each committee are elected by the Board at its first meeting following the annual meeting of stockholders to serve for one-year terms. The current members of our committees are indicated in the following chart:

The Board and its committees held the following number of meetings and acted by unanimous written consent the following number of times during calendar year 2016:

| No. of Meetings | No. of Actions by Written Consent | |||||||

| Board | 9 | 2 | ||||||

| Audit Committee | 23 | — | ||||||

| Compensation Committee | 8 | 3 | ||||||

| Nominating and Corporate Governance Committee | 5 | — | ||||||

We expect members of the Board to attend all meetings. The directors attended, individually and as a group, at least 75% of the meetings of the Board and Board committees on which they served during the period described above.

While we do not have a formal requirement relating to director attendance at our annual meetings of stockholders, all directors are strongly encouraged to attend. The Annual Meeting will be our first annual meeting as a public company and we currently expect that all directors will be in attendance.

Director Qualifications, Nominations and Diversity

The Nominating and Corporate Governance Committee believes that all Board candidates should be selected for their character, judgment, ethics, integrity, business experience, time commitment and acumen. The Board, as a whole, through its individual members, seeks to have competence in areas of particular importance to us such as finance, accounting, international business and relevant technical expertise. The Nominating and Corporate Governance Committee also considers issues of diversity in the director identification and nomination process. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it seeks nominees with a broad diversity of experience, professions, skills, education and backgrounds. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Nominating and Corporate Governance Committee believes that backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, color, national origin, gender, religion or disability.

Directors must be committed to enhancing the long-term interests of our stockholders as a whole and should not be biased toward the interests of any particular segment of the stockholder or employee population. Board members should also be prepared to travel to personally attend meetings of the Board and its committees and should be ready to dedicate sufficient time to prepare in advance of such meetings to allow them to make an effective contribution to the meetings. Further, Board members should ensure that they are not otherwise committed to other activities which would make a commitment to the Board impractical or unadvisable and should satisfy the independence, qualification and composition requirements of the Board and its committees, as required by applicable law, regulation and the rules of the NYSE, our Certificate of Incorporation, our Bylaws and our Corporate Governance Principles.

Our Bylaws describe the procedures a stockholder must follow when nominating a director for election to the Board. Notice of any director nominee to be considered for election at the 2018 Annual Meeting of Stockholders must be received by the Corporate Secretary on or after November 17, 2017 and no later than December 17, 2017. The notice must include certain information about the nominee, including his or her age, address, occupation and share ownership, as well as the name, address and share ownership of the stockholder giving the notice. Our Bylaw requirements are in addition to the SEC’s requirements with which a stockholder must comply to have a stockholder proposal included in our Proxy Statement. Stockholders may obtain a copy of our Bylaws by making a written request to our Corporate Secretary. Any stockholder-recommended director nominee will be evaluated in the context of our director qualification standards and the existing size and composition of the Board.

The Board’s Role in Risk Oversight

The Board has an active role, as a whole and through its committees, in overseeing management of the Company’s risks. The Board’s role in the risk oversight process includes receiving regular reports from members of senior management on areas of material risk to us, including operational, financial and strategic risks. Also, the involvement of the Board in reviewing, approving and monitoring our fundamental financial and business strategies, as contemplated by our Corporate Governance Principles, is important to the determination of the types and appropriate levels of risk we undertake. The Board’s committees, all comprised solely of independent directors, assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Compensation Committee oversees the management of risks relating to our executive compensation plans and arrangements. The Nominating and Corporate Governance Committee manages risks associated with the composition of the Board and other types of risks within its areas of responsibility. The Audit Committee oversees the management of financial risks and also receives regular quarterly reports from our Director of Internal Audit and our Chief Compliance Officer. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Risk Assessment Related to Our Compensation Structure

We believe our compensation practices reflect sound risk management practices and are not reasonably likely to result in a material adverse effect on us. For example, our Compensation Committee and management set performance goals in light of past performance, future expectations and market conditions that they believe do not encourage the taking of unreasonable risks. Our Compensation Committee believes its practice of considering non-financial and other qualitative factors in determining compensation awards discourages excessive risk taking and encourages good judgment. In addition, we believe employee compensation is allocated between cash and equity-based awards, between fixed and variable awards, and between short-term and long-term focused compensation in a manner that encourages decision-making that balances short-term goals with long-term goals and thereby reduces the likelihood of excessive risk taking. Finally, our Compensation Committee has established (a) short-term incentives that balance various Company objectives and provide for maximum payouts, and (b) long-term incentive awards with generally three-year vesting periods, and we believe these program features further balance short- and long-term objectives and encourage employee behavior designed to deter excessive risk taking and achieve sustained profitability and growth.

Compensation Committee Interlocks and Insider Participation

Each of Messrs. Goodyear, Ryan, Seaver and Stewart served on the Compensation Committee of the Board during 2016. During 2016, there were no compensation committee interlocks or insider participation matters.

INFORMATION REGARDING DIRECTOR COMPENSATION

Our Compensation Committee is responsible for recommending non-employee director compensation to the full Board of Directors for approval. Non-employeeThe Company uses a combination of cash and equity compensation to attract and retain qualified candidates to serve on the Board. The Compensation Committee periodically reviews non-employee director compensation with the advice of its independent compensation consultant and makes recommendations to the Board for any changes it considers appropriate. In making such recommendations, the Compensation Committee considers the type and amount of compensation paid to non-employee directors by comparable companies and time required for directors to fulfill their duties to the Company, as well as the backgrounds and expertise required by the Company of members of the Board are compensated in cash and equity.Board. As Executive Chairman of the Board, Mr. Sotir is an officer, but not an employee, of the Company. Mr. Way, who is both a director and our President and Chief Executive Officer, does not receive additional compensation for his service on the Board.

Director compensation levels are reviewed annually by the Compensation Committee.

As reflected in the table below, during 2016, each non-employee director received an annual cash retainer, as well as a payment for each meeting attended. The Executive Chairman of the Board and the chairs of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each received an additional retainer for their services.respectively. All retainers arewere paid in equal quarterly installments. Directors are

| Description of Remuneration | Executive Chairman of the Board | Audit Committee Chairman | Compensation Committee Chairman | Nominating and Corporate Governance Committee Chairman | Lead Independent Director | All Other Directors | ||||||||||||||||||

| Annual Retainer | $ | 45,000 | $ | 45,000 | $ | 45,000 | $ | 45,000 | $ | 45,000 | $ | 45,000 | ||||||||||||

| Other Annual Retainers | $ | 180,000 | $ | 13,500 | $ | 13,500 | $ | 9,000 | $ | 22,500 | — | |||||||||||||

| Meeting Attendance Fee | $ | 1,500 | $ | 1,500 | $ | 1,500 | $ | 1,500 | $ | 1,500 | $ | 1,500 | ||||||||||||

| (per meeting attended) | ||||||||||||||||||||||||

Thereceive an annual grant of common stock. In March 2017, the Compensation Committee determinedapproved an annual grant of fully-vested common stock to non-employee directors valued at approximately $112,500 on the date of grant in February 2017 to maintainrespect of their service in 2017. The number of shares awarded was based on the non-employee directors’ annual retainers atmarket closing price of our common stock on the current levels for 2017.

applicable grant date.

In February 2016, the Compensation Committee approved an annual grant of fully-vested common stock to non-employee directors valued at approximately $112,500 on the date of grant in respect of their service in 2016.stock. The number of shares to be awarded will be based on the market closing price of our common stock on the applicable grant date.

Our stock ownership policy requiresBoard also has adopted guidelines that require each director to own an amount of our common stock equal to at least five times the annual cash retainer amount (which at December 31, 20162017 equals $225,000 of our common stock) within three years of his or her election to the Board. Both directly-owned shares and unvested restricted stock count toward satisfaction of this policy. We measure the stock ownership of our directors annually as of October 31. All of our directors were elected to the Board in late 2015, and therefore have until late 2018 to meet this ownership requirement.

Table

| Name | Fees Earned in Cash ($) (1) | Fees Earned in Stock (1) | Equity Grant ($) (2) | Total ($) | ||||||||||||

| William M. Goodyear | $ | — | $ | 136,500 | $ | 112,500 | $ | 249,000 | ||||||||

| James C. Gouin | $ | 87,000 | $ | — | $ | 112,500 | $ | 199,500 | ||||||||

| John P. Ryan | $ | 31,125 | $ | 88,875 | $ | 112,500 | $ | 232,500 | ||||||||

| Christopher T. Seaver | $ | — | $ | 114,000 | $ | 112,500 | $ | 226,500 | ||||||||

| Mark R. Sotir | $ | 157,875 | $ | 98,625 | $ | 112,500 | $ | 369,000 | ||||||||

| Richard R. Stewart | $ | 89,000 | $ | — | $ | 112,500 | $ | 201,500 | ||||||||

| Ieda Gomes Yell | $ | — | $ | 84,000 | $ | 112,500 | $ | 196,500 | ||||||||

| Name | Fees Earned or Paid in Cash (1) | Fees Earned or Paid in Stock (1)(3) | Stock Grants(2)(3) | Total | ||||||||||||

| William M. Goodyear(4) | $ | — | $ | 109,500 | $ | 112,500 | $ | 222,000 | ||||||||

| James C. Gouin | $ | 72,000 | $ | — | $ | 112,500 | $ | 184,500 | ||||||||

| John P. Ryan(4) | $ | — | $ | 93,000 | $ | 112,500 | $ | 205,500 | ||||||||

| Christopher T. Seaver(4) | $ | — | $ | 90,000 | $ | 112,500 | $ | 202,500 | ||||||||

| Mark R. Sotir(4) | $ | 148,125 | $ | 87,375 | $ | 112,500 | $ | 348,000 | ||||||||

| Richard R. Stewart | $ | 67,500 | $ | — | $ | 112,500 | $ | 180,000 | ||||||||

| Ieda Gomes Yell(4) | $ | — | $ | 60,000 | $ | 112,500 | $ | 172,500 | ||||||||

| (1) | Messrs. Goodyear, Ryan and Seaver, and Ms. Gomes Yell received their retainer and meeting fees in the form of our common |

| (2) | Annual grant of fully-vested common stock to non-employee directors valued at approximately $112,500 on the date of grant in respect of |

| (3) | Represents the grant date fair value of our common stock, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification 718, “Stock Compensation” (“ASC |

| (4) | Following the completion on January 4, 2017 of the Company’s restatement of its 2016 financial statements (“Restatement”), the Company made a grant on January 6, 2017 of common stock under the Amended and Restated Directors’ Stock and Deferral Plan representing payment of retainer and meeting fees paid in stock for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016. Messrs. Goodyear, Ryan, Seaver and Sotir were each paid in stock valued at $102,750, $59,250, $85,500 and $66,750 respectively, and Ms. Gomes Yell was paid in stock valued at $63,750. |

| REPORT OF THE COMPENSATION COMMITTEE |

| COMPENSATION DISCUSSION AND ANALYSIS |

| Name | Title | |

| Andrew J. Way | President and Chief Executive Officer | |

| David A. Barta | Senior Vice President and Chief Financial Officer | |

| Girish K. Saligram | Senior Vice President Global Services | |

| Roger George | Senior Vice President Global Engineering and Product Lines | |

| Christopher T. Werner* | Former Senior Vice President Global Operations | |

| Page | |||

| CD&A Highlights | • Business Overview | 22 | |

| • Our 2017 | 23 | ||

| • Our Executive Compensation Best Practices | 24 | ||

| • Our Compensation Philosophy | 25 | ||

What We Pay and Why | • How We Determine Executive Compensation | 26 | |

| • Executive Compensation Elements | 27 | ||

| • Fixed Compensation | 28 | ||

| • Variable Compensation | 29 | ||

| • Other Compensation and Benefit Arrangements | 35 | ||

| • 2018 Compensation Decisions | 35 | ||

| Compensation Policies and Practices | • Stock Ownership Guidelines | 36 | |

| • Trading Controls and Anti-Pledging and Anti-Hedging Policies | 36 | ||

| • Compensation Policies and Practices Related to Risk Management | 36 | ||

| • Compensation Committee Interlocks and Insider Participation | 36 | ||

| • Executive Offer Letters | 36 | ||

| • Tax and Accounting Considerations | 37 | ||

| Executive Compensation Tables | • 2017 Summary Compensation Table | 38 | |

| • 2017 Grants of Plan-Based Awards | 39 | ||

| • Outstanding Equity Awards at Fiscal Year-End | 40 | ||

| • Stock Vested in Fiscal Year 2017 | 41 | ||

| • 2017 Non-Qualified Deferred Compensation Plan | 41 | ||

| • Potential Payments Upon Termination or Change of Control | 42 | ||

| • Post-Employment Tables | 44 | ||

| • | EBITDA, as adjusted(1) increased 11% from 2016 levels. |

| (1) | EBITDA, as adjusted, is a non-GAAP financial measure. EBITDA, as adjusted, is defined, reconciled to net income (loss) and discussed further in “Appendix A.” |

| What We Do | What We Don’t Do | |||

| ü | Hold an annual Say-On Pay advisory vote | û | No employment contracts with any of our NEOs | |

| ü | Pay for performance | û | No hedging or pledging of, or speculative trading in, Exterran common stock | |

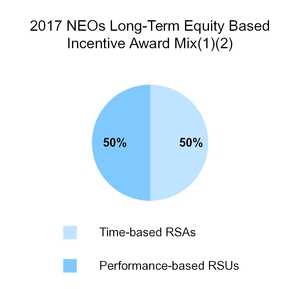

| ü | Target our CEO’s long-term compensation mix so that over 55% is performance-based restricted stock units rather than time-based restricted stock awards | û | No 280G excise tax “gross-up” payments in the event of a change of control | |

| ü | Require a “double trigger” for severance payments or equity acceleration in the event of a change of control | û | No tax “gross ups” on any executive compensation other than relocation benefits available to all eligible employees | |

| ü | Retain an independent external compensation consultant and review independence annually | û | No option repricing or cash buy-outs for underwater options without stockholder approval | |

| ü | Require our CEO to own 6 times base salary in stock and our other executives to own 3 times base salary in stock | û | No perquisites | |

| ü | Require executives to hold substantially all equity compensation received from the Company until stock ownership guidelines are met | |||

| ü | Use an appropriate peer group when making compensation decisions and review it regularly | |||

| ü | Condition grants of long-term equity on non-disclosure, non-solicitation and non-compete restrictions | |||

| ü | Mitigate undue risk-taking in compensation programs | |||

| ü | Require minimum vesting period for executive equity awards | |||

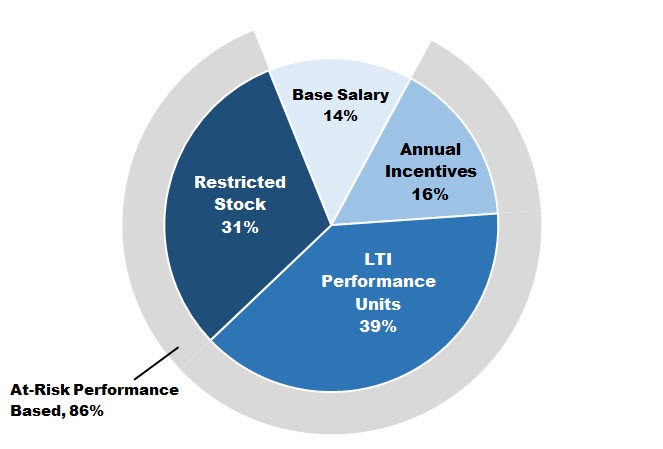

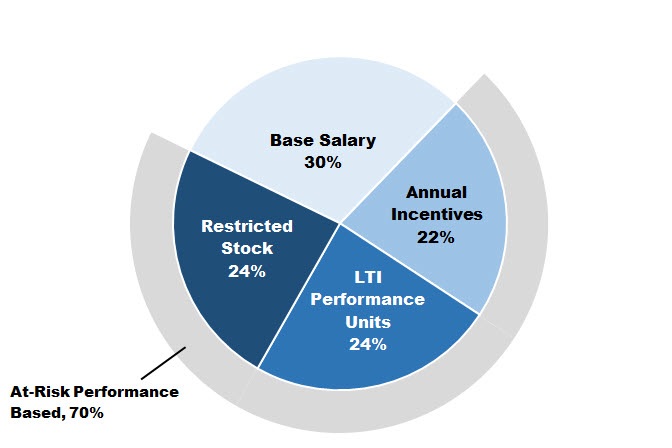

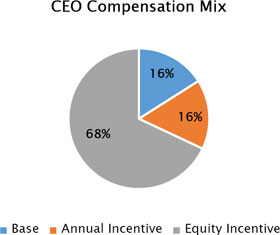

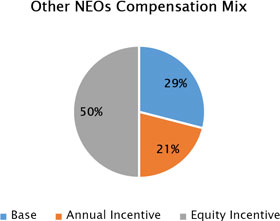

| 2017 CEO Compensation Mix(1) | 2017 Other NEOs Compensation Mix(1)(2) | |

|  | |

| (i) | 2017 base salaries, as discussed on page 28; |

| (ii) | Target annual incentive cash award amounts under the Company’s 2017 Short-Term Cash-Based Incentive Plan, as discussed on page 29; and |

| (iii) | Target grant date fair value of 2017 time-based restricted stockand performance-based restricted stock units, as discussed on page 34. |

| (i) | Mr. Werner’s compensation as Mr. Werner’s employment terminated effective March 10, 2017. |

| (ii) | 2016 LTI awards made to Messrs. Barta, George and Saligram pursuant to the terms of their 2016 employment offer letters in connection with their employment, were not approved and issued until 2017 as a result of the Company’s Restatement. |

| Ÿ | Archrock, Inc. | Ÿ | Forum Technologies | Ÿ | RPC, Inc. |

| Ÿ | Colfax Corp. | Ÿ | ITT, Inc. | Ÿ | ShawCor Ltd. |

| Ÿ | Dril-Quip, Inc. | Ÿ | McDermott International | Ÿ | SPX Flow, Inc. |

| Ÿ | Enerflex Ltd. | Ÿ | Oceaneering International | Ÿ | Superior Energy Services |

| Ÿ | Flowserve Corporation | Ÿ | Oil States International | Ÿ | TETRA Technologies, Inc. |

| Characteristic | Component | Why We Pay | How We Determine | 2017 Decisions | |||

| Fixed | Base Salary payable in cash | Provides a competitive level of fixed compensation during the fiscal year and provides sufficient fixed cash income for retention and recruiting purposes | Competitive data from the peer group, data from salary surveys, internal pay equity, market knowledge from the Committee’s independent compensation consultant and individual performance | No NEOs received adjustments to their base salary for 2017 | |||

| At Risk | Short-term cash-based incentive awards | Intended to motivate and reward executive officers for achieving financial and strategic execution goals over the short-term | Targets determined using competitive data from the peer group, salary surveys, market knowledge of the Committee’s independent compensation consultant and individual performance Payouts based on Company and individual performance for the year; Compensation Committee retains discretion in determining the actual payout | Mr. Way’s annual short-term incentive target was increased to 115% from 100%; other NEOs’ targets were unchanged Strong, operational and financial performance and a review of individual performance resulted in payouts exceeding targets | |||

| Long-term equity-based incentive awards (time-based restricted stock and/or performance-based restricted stock units) | Intended to reward long-term value creation, motivate and retain top talent and align executives’ interests with our stockholders | Award amounts are based upon competitive data, total overall compensation, internal pay equity, historic grants and information provided by the Committee’s independent compensation consultant and individual performance Time-based restricted stock awards have a three-year continued service requirement that provides a retention incentive Performance-based restricted stock units are dependent upon both Company and individual performance and have a continued service requirement that provides a retention incentive | Mr. Way’s long-term incentive target was increased from $3.3 million to $3.7 million; other NEOs’ targets were unchanged. Payout for performance-based awards are consistent with above, up to the maximum specified in the performance-based awards | ||||

| Executive Officer | 2016 Base Salary | 2017 Base Salary | ||

| Andrew J. Way | $750,000 | $750,000 | ||

| David A. Barta | $435,000 | $435,000 | ||

| Girish K. Saligram | $500,000 | $500,000 | ||

| Roger George | $400,000 | $400,000 | ||

| Christopher T. Werner(1) | $300,000 | $300,000 | ||

| (1) | Mr. Werner’s employment terminated effective March 10, 2017. |

| Executive Officer | 2016 Cash Incentive Target (% of base salary) | 2017 Cash Incentive Target (% of base salary) | 2017 Cash Incentive Target ($)(3) | |||

| Andrew J. Way | 100 | 115 | 862,500 | |||

| David A. Barta | 75 | 75 | 326,250 | |||

| Girish K. Saligram | 70 | 70 | 350,000 | |||

| Roger George(1) | N/A | 70 | 280,000 | |||

| Christopher T. Werner(2) | 60 | N/A | N/A | |||

| (1) | Mr. George joined the Company effective December 15, 2016. |

| (2) | Mr. Werner’s employment terminated effective March 10, 2017. |

| (3) | Cash incentive target opportunities are not prorated. |

| Performance Measures | Weighting | What it is | Why we use it | |||

| FINANCIAL PERFORMANCE | Operational measure consistently evaluated each year | Strong correlation to stock price performance and mirrors the Company’s financial disclosure | ||||

| EBITDA, as Adjusted(1) | 30% | Earnings before interest, taxes, depreciation and amortization, excluding Belleli EPC and other items | A critical measure by which our stockholders measure our performance | |||

| OPERATIONAL GOALS | Operational near-term measures aligned to the current operating environment | Aligns with the near-term business plan and annual initiatives; encourages growth in strategic areas of the business | ||||

| Working Capital as a Percent of Sales | 20% | Working capital divided by revenue (measured quarterly and averaged for the full performance period) | Encourages an efficient use of our cash in the operation and promotes strong focus on the controllable elements of our balance sheet | |||

| Growth (Margin Dollars) | 30% | Sum of margin dollars from Contract Operations bookings for 2018 and beyond, 2017 aftermarket services revenue, and 2017 product line bookings (with certain limitedexceptions) | Balances the focus on backlog and revenue growth while improving gross margin | |||

| SAFETY GOALS | Combination of operational and strategic measures that reflect the effectiveness of our global tools, processes and infrastructure and improvements made | Encourages a balance of near-term and mid-term decision making to benefit the health and safety of our employees and contractors and the protection of the environment | ||||

| HSSE - Operational Performance | 10% | Matrix of the number of incident free days and the severity in days away from work due to work-related incidents across the global organization | Encourages a focus on people, safety and the environment | |||

| HSSE - Global Processes | 10% | Investment in new and improved global tools and processes that strengthen the Company’s foundation and enable future growth | Encourages establishment or improvements in tools and processes to enable accelerated organic or acquisition-based growth | |||

| (1) | EBITDA, as adjusted is defined as net income (loss) excluding income (loss) from discontinued operations (net of tax), cumulative effect of accounting changes (net of tax), income taxes, interest expense (including debt extinguishment costs), depreciation and amortization expense, impairment charges, restructuring and other charges, non-cash gains or losses from foreign currency exchange rate changes recorded on intercompany obligations, expensed acquisition costs and other items; provided, however, that adjustments to EBITDA, as adjusted, may be made by the Compensation Committee, in its discretion, for acquisitions or dispositions and unusual items or non-recurring items. EBITDA, as adjusted, as reported in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 is a non-GAAP financial measure, which is discussed further in “Appendix A.” |

| 2017 Short-Term Incentive Plan Performance Goals | 2017 Actual | 2017 Actual Performance % | |||

| Performance Measure | Threshold (0.5x) | Target (1.0x) | Maximum (1.50x) | — | — |

| EBITDA, as Adjusted (in millions) | $155 | $165 | $175 | $175.5(1) | 150% |

| Working Capital as a Percent of Sales | 26.6% | 23.9% | 21.2% | 14.9% | 150% |

| Growth (Margin Dollars)(in millions) | $320 | $360 | $400 | $409 | 150% |

| HSSE - Operational Results(2) | 74 | 70 | 68 | 57.5 | 150% |

| HSSE - Global Process Results(3) | 22 | 33 | 44 | 33 | 100% |

| Total Company | — | — | — | — | 145% |

| (1) | The performance measure of EBITDA, as adjusted, excludes $2.4 million of costs associated with our ongoing operations at our repurposed Belleli EPC facility. |

| (2) | Results are calculated in a matrix that considers severity of work-related incidents and the number of incident free days across global organization. |

| Name | Individual Performance |

| Andrew J. Way | Mr. Way continued his strong and proactive leadership across the organization. His leadership is a driving force behind the Company’s enhanced competitive position, development of the strategic growth playbook, and the solid execution against the annual business plan targets resulting in top quartile total stockholder return. |

| David A. Barta | Mr. Barta was instrumental in leading remediation efforts, in the successful recapitalization efforts in mid-2017, and in the recruitment and retention of a world-class functional leadership team. |